| Receiving Money in Your Agency |

| |

|

Balancing money received on a daily basis or when an employee's shift is over can appear to some agents as overkill, yet having control over daily receipts is essential for an agency's financial health.

Prompt discovery of cash shortages is key in determining the cause. It is easier to identify where the discrepancy lies when the transactions of the day are still fresh in everyone's memory. Thus the reason we recommend utilizing the Daily Transaction Report within InsurancePro and requiring each employee responsible for receiving premiums or commissions to balance at the end of their shift.

When the cause of a shortage is accurately identified, procedures can be implemented immediately to avoid reoccurrence. We also recommend requiring employees to report ALL money discrepancies to management prior to leaving for the day. This direct accountability serves as a theft deterrent. Having to take responsibility for a cash shortage immediately is the last thing a dishonest employee will want to do as it highly increases the likelihood they will be caught.

While a majority of agency owners believe the primary reason to reconcile receipts is to identify cash shortages, it needs to be noted that identifying possible overages can be just as important. An overage indicates money was received but not properly documented. If the money transaction was not properly documented, there is a good possibility the transaction wasn't either. This could lead to coverage not being bound in a timely manner and potentially put the agency at risk for an errors and omissions claim.

|

| |

|

Utilizing the Payment Listing

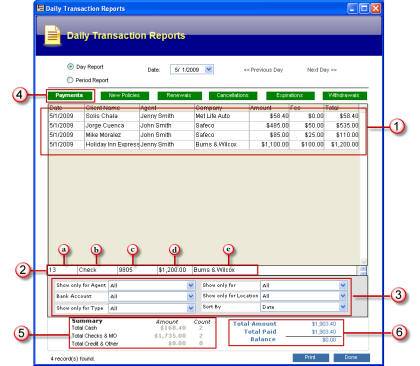

The Daily Transaction Report for Payments was designed for agency employees to balance out at the end of the day. To run this report, simply click on "Daily Transactions" under "Agency Reports" on the left navigational menu. Specify the date(s) you wish the report to cover and then click on the green button labeled "Payments".

Below you will find detailed information on the Payment Listing Report.

|

| |

|

| |

|

|

The list of receipts requested is located here. Clicking on any receipt once will highlight it and additional information for that receipt will appear below (see  ) ) |

|

|

Additional information on a highlighted receipt is provided here. |

| |

|

|

Receipt Number |

| |

|

|

Payment Method |

| |

|

|

Check Number |

| |

|

|

Total Amount Paid |

| |

|

|

Company |

|

|

You can further limit the receipts listed in the Payment Listing by specifying additional criteria here. |

|

|

When you change the criteria, be sure to refresh the report and update your list by pressing the green "Payment" button again. |

|

|

A summary is provided by Payment Method (cash, checks or money orders, or credit cards). |

|

|

Total Paid. If payments were not paid in full and a balance is due, that amount will be listed here. |

|

| |

|

Suggested Cash Handling Procedures

|

| |

|

The Small Business Administration (SBA) estimates as many as 30 percent of employees pilfer and 60 percent will steal if given enough motive and opportunity. We have compiled a list of suggested cash-handling procedures below. These controls can help reduce the opportunity for an employee to steal and provides security measures.

|

| |

-

Enter ALL monies received into InsurancePro immediately upon receipt, no exceptions.

-

Always provide the customer a receipt, even for checks. This will create an accurate date and time stamp for all money received. In addition, it gives the customer the opportunity to verify the amount received is correctly recorded.

-

Assign each employee a separate cash drawer. If all employees are allowed access to the same cash drawer, then it is impossible to determine who the responsible party is in the event of a cash discrepancy.

-

Lock all cash and checks up overnight.

-

Make frequent bank deposits, but stagger the time of day they are made.

-

Each employee should print and sign their Payment Listing acknowledging they have balanced their drawer or listed any discrepancies. This report should be turned into management prior to the employee leaving for the day.

-

All employees should be required to immediately report shortages or overages to Management prior to leaving for the day.

|

| |

|

Download a Cash Handling Policy Template

|

| |

|

Create a cash handling policy and require each employee to sign acknowledging receipt of such. A sample Cash Handling Policy can be downloaded by clicking here. However, we recommend having an attorney review it prior to implementation to verify it is compliant with your state laws.

|

| |

|

Can I dock an employee's paycheck for cash shortages?

|

| |

|

A common question many employers ask, "Can I dock an employee for cash shortages and/or theft"? While the Fair Labor Standards Act does permit cash shortages and/or theft to be deducted from an employee's paycheck, there are strict limitations on how it can be done. In addition, state payday laws may supersede federal law and either forbid the practice all together or impose additional stipulations. Additional information on federal and state payday regulations can be found by visiting:

|

| |

|

US Wage and Hour Division - http://www.dol.gov/esa/whd

State Labor Offices - www.dol.gov/esa/contacts/state_of.htm

|

| |

|

When you purchased InsurancePro, you took the first step in creating effective cash handling controls. By automating the entire workflow process of receipting monies and implementing a written cash handling policy in your agency, you will increase the return on your investment in InsurancePro as well as decrease your exposure to E&O claims and the risk of an employee misappropriating your client's premium payments.

|